Irs Gift Tax Rules 2025. The faq at irs.gov gives guidance to trying to wrap your arms around many mindboggling rules. The irs typically adjusts this gift tax exclusion each year based on inflation.

In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). Two factors determine how much.

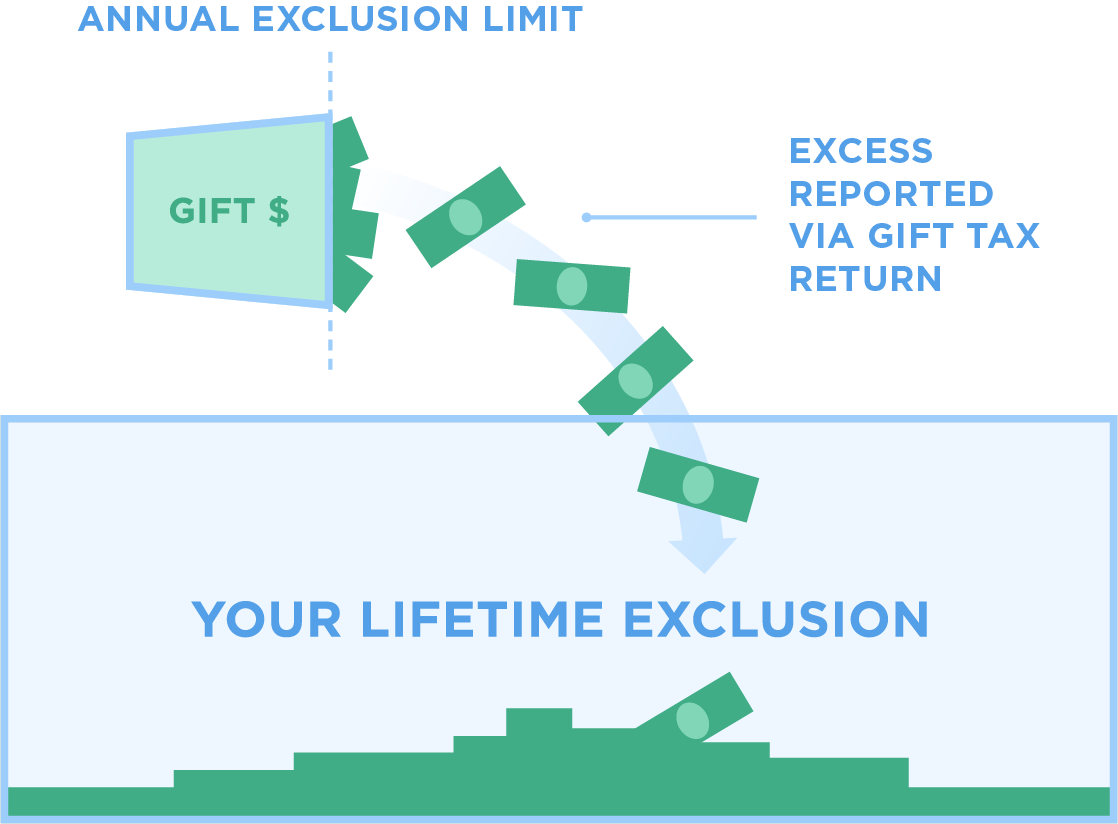

IRS Gift Limit 2025 Rules for Spouses, Minors, Tax Rates, and TaxFree, For 2025, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2025. The irs recently announced that the annual gift tax exclusion for tax year 2025 will increase to $18,000 for individuals and $36,000 for married couples filing jointly.

Irs Gift Rules 2025 Maris Shandee, For 2025, the annual gift tax limit is $18,000. Starting on january 1, 2025, the annual exclusion on gifts will be $18,000 per recipient.

Annual Tax Free Gift Allowance 2025 Amata Virginia, (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.) for married couples,. However, the good news is that while large gifts may require you to file with the irs, very few taxpayers will create a tax liability by exceeding the annual gift threshold.

401 K Contribution Limits 2025 Cheri Honoria, This means that you can give up to $13.61 million in gifts throughout your life without. For 2025, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2025.

What Is The Gift Tax Limit For 2025 And 2025 Jori Vinnie, There's no limit on the number of individual gifts. The annual exclusion applies to gifts of $18,000 to each donee or recipient per.

Gift Tax Rules 2025 Junia Margery, However, the good news is that while large gifts may require you to file with the irs, very few taxpayers will create a tax liability by exceeding the annual gift threshold. In 2025, you can give gifts of up to $18,000 to as many people as you want without any tax or reporting requirements.

Irs Gift Tax Return 2025 Devin Feodora, But the irs also allows you to give up to $17,000 in 2025 and $18,000 in 2025 to any number of people. The faq at irs.gov gives guidance to trying to wrap your arms around many mindboggling rules.

Irs Max Gift 2025 Jodie, The gift tax is intended to discourage large gifts that could. On or before april 15 of the calendar year following the year in which a gift is made, the individual making the gift must file a gift tax return (form 709, united states.

Gift Tax 2025 Rate Zorah Bethanne, What is the gift tax? There's no limit on the number of individual gifts.

Gift Tax Limit 2025 Exemptions, Gift Tax Rates & Limits Explained, Charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040. That number changes annually, rosen.

The gift tax is a federal tax on transfers of money or property to other people who are getting nothing or less than full value in return.